Understanding the Risks of & Fixes to the National Debt

Around two centuries ago, the 7th U.S. President, Andrew Jackson, declared that the $58,000,000 U.S. national debt had been fully paid.

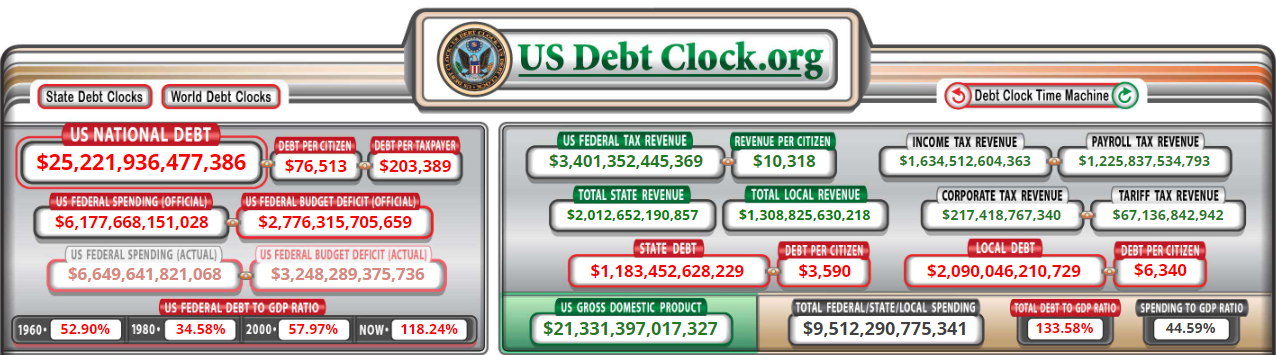

As of May 2020, the US national debt is around $25,000,000,000 and counting. That’s $25 TRILLION if you don’t want to count all those zeroes.

The Congressional Budget Office (CBO) predicts that, by 2030, the debt-to-GDP ratio will reach its highest point since World War II.

$25 trillion of the US national debt. What does that even mean? The figure is so large it instills fear in most of us, but only in a vague way. The implications—the real, concrete consequences—to everyday Americans often gets lost when we see these inconceivably large numbers.

Let’s break it down and keep it simple, so you can educate yourself on how the increasing U.S. national debt could seriously affect the U.S. and you in the future.

What is national debt?

DEFINITION

The national debt is the total amount of money the federal government owes to its creditors.

An annual budget deficit is when the federal government spends more than they bring in (through taxes) during the span of one year.

The national debt is the sum of annual budget deficits.

Having an annual budget surplus decreases the national debt.

To make these concepts easier to relate to and comprehend, let’s think about the national debt on an individual scale.

If you’re debt-free, saving and/or investing money, congratulations! That’s one indication you’ve been fiscally responsible. You are operating on a budget surplus, annually and net. Similarly, a key sign that a country is being run well is if it’s operating on a national surplus.

On the other hand, there are many cautionary tales of people getting overwhelmed by credit card debt. Their debt just grows bigger and bigger because of interest, further spending, and further borrowing. They are operating on a budget deficit, annually and net. When a country consistently runs on a deficit and ends up with massive current national debt ($25 trillion!), that’s a key indicator that it is not being run well—at the very least, economically speaking

How can a country have national debt?

The federal government makes all its money through taxes. Sales tax, personal income tax, corporate tax, and so on. That’s all going to the federal government, so it can keep its operations going.

Ideally, it operates on less than that, so the government doesn’t have to borrow money to invest in economic expansion.

Since we’re experiencing annual budget deficits year after year, the federal government must be spending more than our tax dollars. So where’s this extra money coming from? How can a country even spend money it doesn’t have?

Again, think about things on an individual scale. If you want to purchase a home but are not looking to eat into your savings all at once, you can take out a loan to help you offset the significant costs and payback the bank in installments.

The point is: you’re using money that isn’t yours, money which you have to pay back in full plus interest.

The same applies to the federal government. It borrows money, too, just on a massive scale. That’s how it can spend more than it has, but that has led and will continue to lead to more and more debt on its books.

The U.S. national debt, in specific, can be split into two main categories:

- Public debt (~74% of U.S. national debt—the money owed to purchasers of securities (treasury bills, notes, bonds, and more). The government lets purchasers invest in securities in exchange for cash. The selling point is the purchaser is guaranteed more money, after a set period of time, than they used to pay for the security.

- Intragovernmental debt (~26% of U.S. national debt)—the money the government owes to one of its agencies. For example, the Social Security Trust Fund often makes more revenue from taxes than it needs to operate. With its excess cash, it invests in Treasury notes.

| NOTE | In 10-13 years, the US won’t be able to pay interest on its debt and will have to default (if things continue as is). The bailout will involve printing trillions of dollars, thus causing inflation. Everyone will suffer financially. What is your tax money funding? |

What is your tax money funding?

For many, you make sure to pay your taxes to Uncle Sam. You aren’t quite sure where your money’s going, but you do it all the same.

According to USAspending.gov, ~66% of tax revenue in 2018 funded:

- Medicare and Health ($1.35 trillion/28%of total)

- Social Security ($1 trillion/23% of total)

- National Defense/Military ($688 billion/ 15% of total)

The other ~44% goes to public education, transportation, veterans’ benefits, and so on. Most years, tax money is divided up in percentages close to those provided above. However, if you look at the numbers around WWII or the Vietnam War, national defense spending shoots up considerably.

Why has the U.S. accumulated so much national debt?

You hear it all the time, the U.S. is a superpower! Yet, that doesn’t seem to jive with the $25 trillion of the US debt. Why does the world leader owe so much?

Here are some of the major events and/or decisions that have contributed to the drastic increase in the national debt since the 2000s:

- Tax Cuts—The 2001 & 2003 “Bush” Tax Cuts & Trump’s Tax Cuts and Jobs Act of 2017

If we’ve made one thing clear, it’s that the government takes on debt if they spend more than they make. Cutting taxes, then, reduces the amount of funds the government can use without adding to the national debt.

- National Defense—Wars in Afghanistan, Iraq, Syria, and Pakistan

Since 2001, the U.S. has spent ~$5.9 trillion to fund its long conflicts with multiple nations.

- Great Recession—The Emergency Economic Stabilization Act

$700 billion of taxpayer money went to bailing out banks after the Great Recession in 2008. Supposedly over $12.3 trillion has gone to rescue the economy.

Learn how you can protect your money with the USD Project. We’ll keep you updated on the latest happenings that could affect your savings.

Risks of the U.S. national debt

So we’ve addressed most of the key questions:

✔ What is national debt?

✔ How does a country get national debt?

✔ Where does your tax money go?

✔ Why does the U.S. have so much national debt?

But, I know you’ve got one more on your mind:

how does the national debt affect me?

Increased chance of default

Default is when you, or even a country, can’t pay a debt. If the U.S. cannot pay its bondholders, the value of those bonds drop. The supposedly guaranteed return just isn’t there, making the yield even higher. In other words, to keep attracting investors, the Treasury would have to offer even bigger payouts because of the increased risk.

Tax money will have to go to paying off bigger and bigger debts. It’s a vicious cycle.

Furthermore, foreign countries such as China and Japan own ~30% of U.S. debt. They’ve invested trillions of dollars into our bonds. Because the USD serves as the global currency, a global recession is not so far fetched if default occurs.

The average American will experience a considerable decline in quality of life. Your tax money will be going to paying off that $25 trillion, not to social security or health care.

Inflation & high-interest rates

With the instability of the USD, corporations will have to pay more interest on their loans because of the heightened risk. Thus, to stay afloat, businesses will need to raise the pricing of their products and services to meet their increased debt obligations.

Borrowing money in general will also cost much more, as interest rates will be at an all time high.

Americans will have to pay more for the same products and services while their savings lose value.

Loss of investments

Considering the default, the Treasury will offer high yield securities with very little risk. This is to, again, attract investors, so the federal government can pay off its outstanding debts.

High reward-low risk securities are ideal for the investor. These easy investments mean people will be less inclined to take risks on corporate debt and equity, especially with the high interest rates. The government, then, gets the funds it needs while the private sector suffers.

KEY TAKEAWAY

If the U.S. defaults on its debt obligations, the whole world is going to suffer, not just you. American lives, humble or luxurious, will all take a hit. The U.S’s social, political, and economic standing will be lost, irrevocably. But on an individual scale, your savings, your hard-earned cash, will lose considerable value.

Fixes to the U.S. national debt

We’re not going to come out and proclaim we have THE answer. It’s obviously not going to be a quick and easy fix, otherwise we probably wouldn’t be where we are today. Nevertheless, there are proven methods we can take that should start chipping away at the $25 trillion mountain. None of them is a panacea, but a combination of strategies over a sustained period of time will go a long way in reducing the U.S. debt.

Reduce spending (+ increasing taxes)

There have been examples of countries reducing debt by cutting government spending without increasing taxes. Trimming the excess fat is simply good practice that the government does not do enough of. Canada performed an extreme budget cut of 20% over the span of four years, reducing the public debt by a third.

How about we spend the same amount, but increase taxes?

You know and we know that nobody’s going to be happy paying more taxes. Also, keeping tax revenue the same might be better in eliminating the current national debt. Spending, not taxation, is the problem. Increasing taxes has often led to more ill-advised spending, which perpetuates the national debt year after year.

Countries, in especially dire situations, can reduce spending and increase taxes. Coupling these two strategies expedites the process. Citizens, however, will have to do with less.

Interest rate reduction

To stimulate the economy and increase tax revenue, countries can keep interested at a reduced rate. People will be more willing to spend their money, bringing money, growth, and new job opportunities. Also, businesses and individuals will be more inclined to borrow, and therefore, spend money because of the low-interest rates.

Bailout

In a word: Greece.

It simply doesn’t have a history of working. Who’s going to help out the U.S. in a substantial way? China? Nations have received billions of cash infusions before, and it did little to get them back on track.

Default

Although countries like North Korea and Argentina managed to reduce their debt by default, the global banking community did not particularly appreciate it. When a country defaults, it renegotiates the debt amount and/or payment structure. We already went over this in the risks, but if a country with the influence of the U.S. defaults, the consequences will be global. The world would likely go into another recession.

Conclusion

It should be clear that the national debt could seriously affect you. If the debt continues to pile up, the chance of the U.S. defaulting increases. The potential collapse of the USD will seriously damage the global economy. Everyone, especially the everyday people, will be hit hard.

KEY TAKEAWAYS

- National debt is produced when a country consistently spends more than they make

- Government debt will just continue to increase, especially considering the interest

- High-interest rates make borrowing money inadvisable but if you need to keep you or your business afloat, you might have to take that on

- Foreign countries will hesitate to invest in the U.S. economy because of its instability

- Loss of political, social, and economic standing

This is a good time as any to be on the lookout for alternative safe-haven currencies. You don’t want you or loved ones hurting from the government’s mismanagement.

Protect your money from potential crises

USD Project is a non-partisan, community-driven inquiry into the risks and fixes of the US dollar, and potential safe haven currencies for US citizens. Through podcasts and articles, USD Project informs you on how to best protect your hard-earned money during times of crisis.

Join our growing community and drive our discussions with your vote!