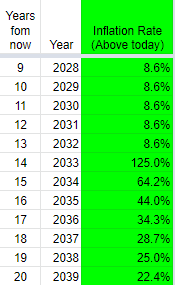

Find the YEAR damage begins with the US National Debt Crisis.

The best estimate on when the main damage will happen

Year is the estimated year where the US National debt’s “Credit card” (aka the US Treasury market) maxes out.

Why is 2033 when the main damage happens?

-

Up until this point, we keep growing the US National debt’s “Credit card” (aka the US Treasury market)

-

At this point, the USA will switch over to MONEY PRINTING in order to pay the Interest on the national debt and the Deficit.

-

The Money printing is what will cause very extreme amounts of inflation.

125%!

Money printing increasing the currency supply so suddenly and by so much, causes inflation at an estimated 125%

Why does the damage happen so suddenly?

The problem with the US National Debt crisis is that the problem goes from:

The damage isn’t felt Now…

Because we just keep increasing the country’s “Credit card” or US Treasury market) to keep taking on all of the debt. Since the debt goes there instead of printing money, the inflation doesn’t happen at this point

It happens suddenly…

When the US Treasury market maxes out. Then over night, we shift to printing money. The problem is that by this team, the amount of INTEREST and DEFICIT are so large that the money printed in that SINGLE year will cause 125% inflation.

Watch this video to learn more about US national debt.

https://youtu.be/jM37zW7ylFA

National Debt Strategic Calculator

View Strategic Tax Issues